Keywords: Superannuation System

-

ECONOMICS

- David James

- 29 January 2025

A plan to raise superannuation taxes on high-value funds has stalled in the Senate, sparking a broader debate about government control over retirement savings. Rooted in a unique system that places ownership squarely with individuals, Australia’s approach has delivered impressive returns, yet political pressures threaten to reshape its future.

READ MORE

-

AUSTRALIA

- Claire Heaney

- 13 December 2024

For years, Coles and Woolworths have been accused of squeezing both producers and shoppers in equal measure. With new regulatory changes on the horizon and a web of inquiries underway, the supermarket duopoly finds itself under unprecedented scrutiny. But will these reforms actually lower grocery bills?

READ MORE

-

ENVIRONMENT

- Phil Jones

- 28 November 2024

1 Comment

Infinite economic growth on a finite planet is a paradox we can no longer ignore. As environmental crises deepen, solutions like the Steady State Economy offer a roadmap to balance sustainability and prosperity. Yet, transitioning from growth-centric systems raises hard questions: Can we create an economy that values life over profit?

READ MORE

-

AUSTRALIA

- David James

- 24 October 2024

3 Comments

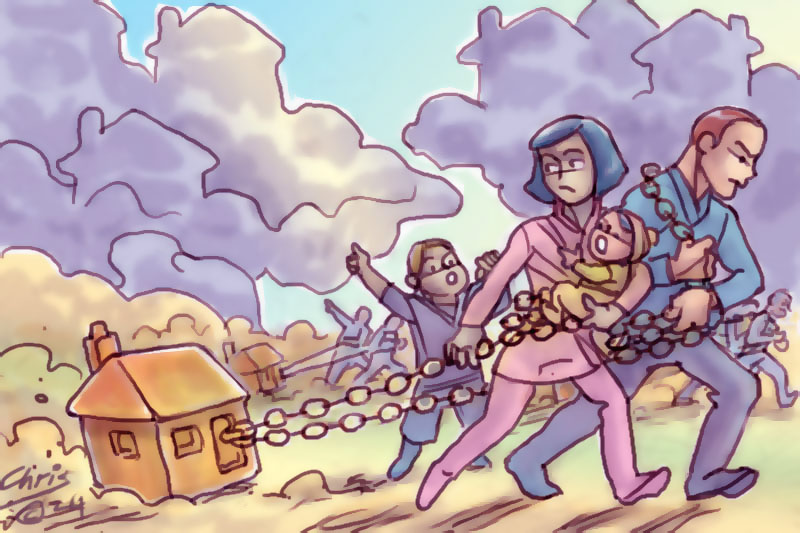

Soaring property prices and declining fertility rates are entwined in a feedback loop, threatening long-term economic stagnation. As younger Australians are priced out of the market, many are delaying or forgoing parenthood, leading to an increasingly divided and unsustainable society.

READ MORE

-

AUSTRALIA

- Adam Hughes Henry

- 08 October 2024

5 Comments

Australia’s housing crisis is increasingly seen as a byproduct of system rigged for the wealthy, while ordinary Australians grapple with debt and rising costs. As home ownership becomes increasingly out of reach, it's time to rethink housing as a right, not just a means of wealth accumulation.

READ MORE

-

AUSTRALIA

- Joe Zabar

- 17 September 2024

2 Comments

As Australia heads toward the 2024 federal election, voters are grappling with soaring costs of living, stagnant wages, and weak GDP growth. Inflation is easing but prices remain stubbornly high. Will the Albanese government’s strategies to combat inflation satisfy an increasingly strained electorate?

READ MORE

-

ECONOMICS

- David James

- 23 August 2024

1 Comment

The term 'reform' carries an ambiguous weight. It can signify progress but just as often masks harmful change. Paul Tilley’s Mixed Fortunes explores the messy evolution of Australia's tax system, revealing how reforms, far from delivering clarity or fairness, reflect deeper ideological struggles over power and economy.

READ MORE

-

AUSTRALIA

In a signature essay published last year in The Monthly, Treasurer Chalmers staked out an ideological terrain he described as ‘values-based capitalism.’ The Budget 2024 is quite the big reveal on what those values include and who they exclude. In it, the people who have borne the brunt of inequality and precarity are neither seen nor heard.

READ MORE

-

AUSTRALIA

- Joe Zabar

- 12 February 2024

1 Comment

Much of the discussion about tax reform is about the mechanisms of collection; around changes to things like negative gearing, stamp duty, land tax, capital gains tax, and superannuation. But what is missing is a statement of values about what we expect our tax system to fund.

READ MORE

-

ECONOMICS

- David James

- 23 November 2023

If money is just a set of rules, we need to ask, how can these rules best serve society and not cause crises? We know, after thousands of years of evidence, that the debt-based system of money eventually self-destructs, and this time, the effects are likely to be felt around the world.

READ MORE

-

AUSTRALIA

- Mark Gaetani

- 12 October 2023

3 Comments

Beneath the facade of Australian prosperity lies a hidden country where over three million citizens, including a staggering 761,000 children, grapple daily with the hard choices that come with poverty. With an urgent need for reform, what policy shifts could bring about the transformation this nation needs?

READ MORE

-

AUSTRALIA

- Mark Gaetani

- 02 September 2023

A new report for St Vincent de Paul Society suggests minor tax and welfare tweaks could lift 834,000 Australians from poverty. Amidst skyrocketing rents and income disparities, the call for an empathetic economic overhaul is louder than ever.

READ MORE