Section: Economics

There are more than 200 results, only the first 200 are displayed here.

-

ECONOMICS

- David James

- 19 October 2015

7 Comments

For those who believe, as G. K. Chesterton quipped, that the popular press is 'a conspiracy of a very few millionaires', the decline of mainstream media may not seem such a great loss. But the thinning of journalistic ranks is not good for democracy. In the world of business, old habits usually do not die at all — it is rather the businesses themselves that experience terminal decline. What journalism that does emerge from the ashes of the existing mainstream media businesses will be very different.

READ MORE

-

ECONOMICS

- David James

- 14 September 2015

1 Comment

The recent ructions in the Chinese stock market set off great consternation in global financial markets, but for the most part this was a display of ignorance. One of the reasons China’s influence on global markets has been so beneficial, since at least 2007, is that its economy and financial markets are so different.

READ MORE

-

ECONOMICS

- Lucas Smith

- 14 August 2015

4 Comments

G. K. Chesterton said that 'too much capitalism does not mean too many capitalists, but too few capitalists'. In our young century, we have lost capitalists, and wealth has coagulated to a seemingly smaller and smaller number of financiers, oligarchs and corporations. The stock market is where entrenched wealth is kept and made. An industry-shattering share-trading app is set to help deepen our pool of capitalists.

READ MORE

-

ECONOMICS

There has been great pressure on both of the major political parties to stop giving so-called rich retirees partial pension income. The conventional view has become that retired millionaires should not be feeding off the public teat. But in terms of income, many of those 'rich retirees' would actually be better off on the pension.

READ MORE

-

ECONOMICS

International Monetary Fund prescriptions have a long history of failing, and countries that ignore them are often the ones that do surprisingly well. Few have been asked to be more servile than the Greeks. When the IMF came in with what is amusingly referred to as its austerity 'plan', the Greek economy was expected to grow at over 2 per cent. After the 'plan' had taken effect, the country’s economy had shrunk by a quarter.

READ MORE

-

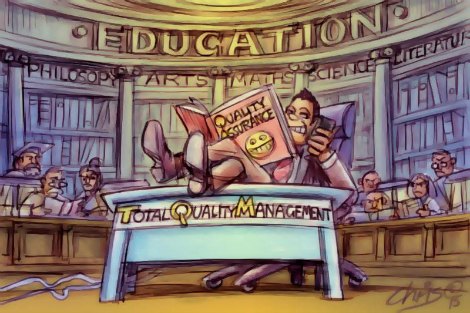

ECONOMICS

Allowing such a flimsy discipline as management to co-opt an area as important as education, as appears to be the trend, is as absurd as it is saddening. Education has been with us for thousands of years and encompasses some of the most profound thinking the civilisation has produced. Management thinking has been with us for a few decades and has accomplished next to nothing.

READ MORE

-

ECONOMICS

- David James

- 28 April 2015

2 Comments

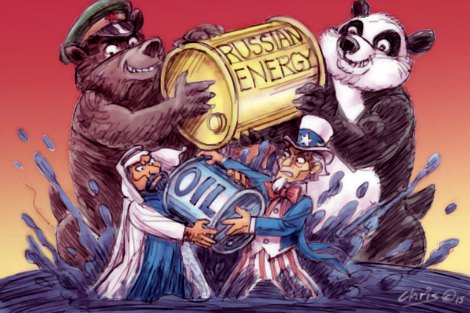

The conflict in the Ukraine has attracted a great deal of attention for its geo-strategic implications. Less noticed have been the economic implications. The sanctions placed on Russia have forced Russia to become even closer to China, and the alliance between a military superpower and an economic superpower is beginning to split the global economy in two. It may come to represent the biggest geo-economic and geo-political shift of the first half of this century, defining much of the future landscape.

READ MORE

-

ECONOMICS

- David James

- 06 March 2015

8 Comments

The 2015 Intergenerational Report is reminiscent of a comment by that great 20th century philosopher and baseball player Yogi Berra: 'It’s tough to make predictions – especially about the future.' Many economic commentators have pointed out, rightly enough, that Treasury cannot even get its one year predictions right. Nevertheless, it is worth looking at how the 40 year forecasts are constructed to see the kind of thinking involved.

READ MORE

-

ECONOMICS

- David James

- 16 February 2015

3 Comments

Sanctions against Russia have pushed Russia and China much closer together. Russia is set to provide two fifths of China’s gas needs after the completion of two massive pipelines. This will easily replace what they have lost in supplying Europe and deliver what the Chinese most crave: security of supply. Meanwhile, Russia has cut off 60 per cent of its supplies of gas into Europe, re-routing it to Turkey, and saying that Europe will have to build its own infrastructure to transport it to the Continent.

READ MORE

-

ECONOMICS

- David James

- 10 December 2014

12 Comments

One of the fascinating aspects of Australia's political pantomime is the manner in which the Federal Treasurer is forced to metamorphose into a used car salesman who is spruiking the Australian economy. One reason for the relative impotence of the Treasurer is that the Federal government only has control over fiscal policy. Monetary policy, the interest rate, is set by the Reserve Bank, not the government.

READ MORE

-

ECONOMICS

- David James

- 19 November 2014

6 Comments

Investing capital in the production of goods and services may create jobs, but it's not the best way to make money. It's more profitable to manipulate the financial system to create more money from money, which is why the finance sector does so well. The polarisation of wealth is less extreme in Australia, but we have our own capital-driven Ponzi scheme - the residential property market, which has become an exercise in making money out of money.

READ MORE

-

ECONOMICS

- David James

- 13 October 2014

7 Comments

Federal Finance Minister Mathias Cormann announced 'the scoping study found no evidence that premiums would increase as a result of the sale' of Medibank Private. But the sale is being presented as a way to make the fund more efficient. If successful, Medibank Private will become even more dominant than it is at present and there will be pressure to raise premiums to achieve its purpose of keeping shareholders happy.

READ MORE