Section: Economics

There are more than 200 results, only the first 200 are displayed here.

-

ECONOMICS

- Collince Adienge

- 31 July 2017

7 Comments

When limitations are placed on an individual’s liberty some people will call it bureaucracy or tyranny; others will say that they have been denied an opportunity to make decisions. The common sense middle position is typically that freedoms should be protected if they do not infringe on other peoples’ rights.

READ MORE

-

ECONOMICS

The daily fluctuations of financial markets and the fractious debates over economic policy are concealing something deeper and much more disturbing. The future of money itself is in question. A decade after world banking almost collapsed in the global financial crisis, the questions raised have not been answered.

READ MORE

-

ECONOMICS

One of the more interesting recent developments in finance has been the creation of Bitcoin and other crypto-currencies. They are being touted as a revolution in how we think and use money. Alternately, there are many who want to go in the opposite direction, back to the gold standard. Both sides have a common enemy: money whose value is determined by government dictate. Allowing governments to dictate in this way, they argue, is the core of the problem. To a significant extent, they are wrong.

READ MORE

-

ECONOMICS

One thing that is rarely done is a literary-style analysis of the language used in finance and business. It can quickly reveal the sleight-of-hand, even outright deception, that plague these powerful sectors. To take one example, finance language heavily relies on water metaphors, which are deeply misleading. It is unlikely that this is done deliberately; it is more probably reification (making the intangible appear to be concrete). But its consequences have been, and remain, devastating.

READ MORE

-

ECONOMICS

- Rachel Kurzyp

- 15 May 2017

3 Comments

Kids these days. We can't hold down a job, we expect to be promoted before we've proven ourselves and we put our career needs before the needs of an organisation. We're the largest age group, making up 37 per cent of the Australian workforce, yet we're expected to shut up and wait our turn. What is it about millennials that has everyone scared? People claim the stereotype is based on generational cohort, not age. But for young Australians in the workforce, they are one and the same thing.

READ MORE

-

ECONOMICS

The $6.2 billion the government will raise through a levy on bank liabilities not only shows how out of favour banks have become, it is also, in effect, a de facto tax on property lending - a counterbalance to negative gearing and capital gains tax breaks. It is a tax on property lending because nearly all the banks' loans are mortgages for housing, or business loans secured with property. Of course the banks will pass the extra cost on to their customers, so it becomes a tax on borrowers.

READ MORE

-

ECONOMICS

Fake news aside, increasingly, we live in a world of fake figures. There is a cliche in management that 'what gets measured gets done'. In public discourse that might be translated to 'what gets measured is considered real'. One obvious fake figure is GDP, which is taken as a measure of national wellbeing. In fact, it is just a measure of transactions. If money changes hands because something disastrous happens then GDP will rise. That is hardly an indicator of national wellbeing.

READ MORE

-

ECONOMICS

- Daniel Nicholson

- 24 April 2017

3 Comments

When you are in the business of exploiting people, language matters. A recently leaked document from Deliveroo is geared to emphasising that the people who deliver food for Deliveroo are and should remain independent contractors, not employees. In 2016, a Unions NSW report into the employment practices of gig-economy company AirTasker categorised the online labour market as 'unregulated Taylorism within a Dickensian marketplace where workers compete for bite-sized fragments of labour'.

READ MORE

-

ECONOMICS

- David James

- 04 April 2017

13 Comments

It is increasingly evident how pernicious the privatisation myth is. Two recent examples have underlined it: the failings in Australia's privatised energy grid and the usurious pricing in airport car parks. Both demonstrated that it is folly to expect a public benefit to inevitably emerge from private profit seeking. The purpose of government funded public infrastructure is not to make profits but to lower the cost of doing business, sometimes called the socialisation of the means of production.

READ MORE

-

ECONOMICS

- David James

- 07 March 2017

17 Comments

Witnessing the debate over Sunday penalty rates, an intriguing pattern of thinking emerged. It can be characterised as a microcosm/macrocosm duality. Those arguing for lower Sunday wage rates demonstrate their case by talking about individual businesses, the micro approach: 'Many businesses would love to open on a Sunday and if wage rates were lower, they would. Unleash those businesses and greater employment will follow.' Superficially impressive, this does not survive much scrutiny.

READ MORE

-

ECONOMICS

- David James

- 07 February 2017

10 Comments

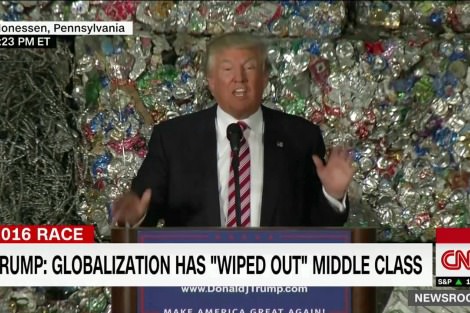

Many defenders of globalisation express frustration at the rise of Trump and what they see as an ignorant and self-defeating backlash against its virtues. But they have no answer to the most pressing question: Is the global system there to serve people, or are people there to serve the global system? They also never address a central contradiction of globalisation: that capital is free to move, but for the most part people are not, unless they belong to the elite ranks.

READ MORE

-

ECONOMICS

- Rachel Kurzyp

- 16 December 2016

8 Comments

Studies have found that in Australia, groups with the poorest financial awareness and skills are those under 25, those with no formal post-secondary education, those on low incomes and working 'blue collar occupations', and women. While it makes sense to provide these groups with financial information on home loans and super, this wouldn't have helped my mother when she had to decide between, say, buying groceries for the week or getting the car serviced.

READ MORE