Keywords: Retirement Savings

-

ECONOMICS

- David James

- 29 January 2025

A plan to raise superannuation taxes on high-value funds has stalled in the Senate, sparking a broader debate about government control over retirement savings. Rooted in a unique system that places ownership squarely with individuals, Australia’s approach has delivered impressive returns, yet political pressures threaten to reshape its future.

READ MORE

-

AUSTRALIA

- Adam Hughes Henry

- 08 October 2024

5 Comments

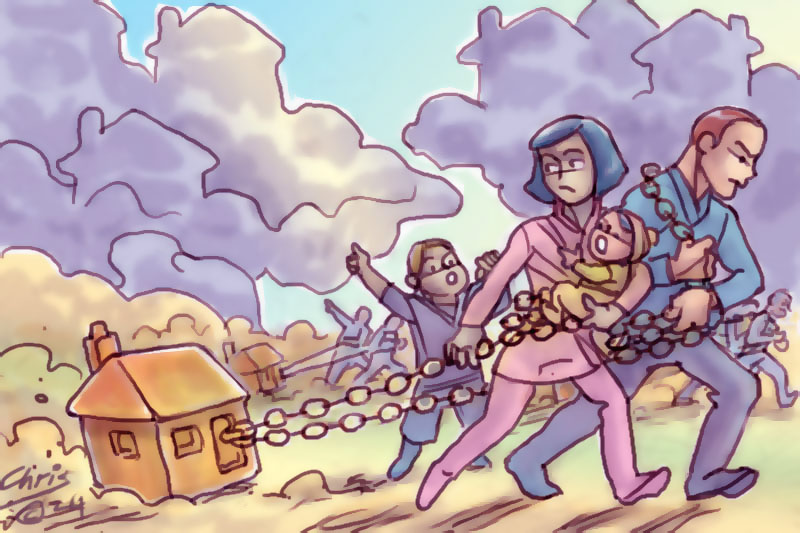

Australia’s housing crisis is increasingly seen as a byproduct of system rigged for the wealthy, while ordinary Australians grapple with debt and rising costs. As home ownership becomes increasingly out of reach, it's time to rethink housing as a right, not just a means of wealth accumulation.

READ MORE

-

AUSTRALIA

- Jennifer McVeigh

- 25 May 2023

4 Comments

A rapidly growing cohort of homeless women over 55 has become the new casualties of Australia's housing market. With skyrocketing rents, an entrenched gender pay gap and inadequate pension funds, older women are slipping through the cracks owing to a tangle of systemic failures.

READ MORE

-

ECONOMICS

- David James

- 08 April 2021

5 Comments

It is one of the ironies of Australian political history that a policy that has profoundly benefited this country’s version of capitalism came, not from the right, but from the Labor party and unions. The mandating of superannuation payments in 1992 under the Keating government has profoundly changed Australia’s financial system.

READ MORE

-

AUSTRALIA

- Fatima Measham

- 12 April 2018

10 Comments

How comfortable does anyone really need to be? The amounts of money that get quoted in remuneration packages or property portfolios is incomprehensible to many Australians who manage to survive, even thrive, on so much less. Inequality seems to be driven by an incapacity to recognise what is enough and to stop.

READ MORE

-

AUSTRALIA

- Francine Crimmins

- 14 April 2017

15 Comments

As a millennial, I frequently find myself being told to stop complaining about housing affordability. It's all about working harder, saving more and, for goodness' sake, keeping off the avocado. As a young person, I'm concerned about using super, a system which was put aside for our economic welfare in retirement, as a savings account for instant gratification. The government is trying to solve the housing crisis not through direct action, but by encouraging young people into lifelong debt.

READ MORE