Keywords: Global Financial Crisis

There are more than 200 results, only the first 200 are displayed here.

-

ECONOMICS

- David James

- 14 October 2024

Advanced industrial societies are running out of ideas, masking stagnation with financial trickery, which is now faltering. In contrast, developing nations can clearly advance through industrial phases, especially by building infrastructure. For them, the path to improving lives is clear; for developed nations, it remains uncertain.

READ MORE

-

ECONOMICS

- David James

- 10 September 2024

As continued high interest rates and stagnant incomes put a strain on households, leading more Australians give up on the dream of home ownership, government attempts to manage both the cost of living crisis and the housing crisis may be doing too little too late.

READ MORE

-

AUSTRALIA

With homelessness rising and housing affordability plummeting, Independents propose a radical solution: a National Housing Plan. In challenging both major parties, can they create a system that provides a roof over the heads of all Australians?

READ MORE

-

ECONOMICS

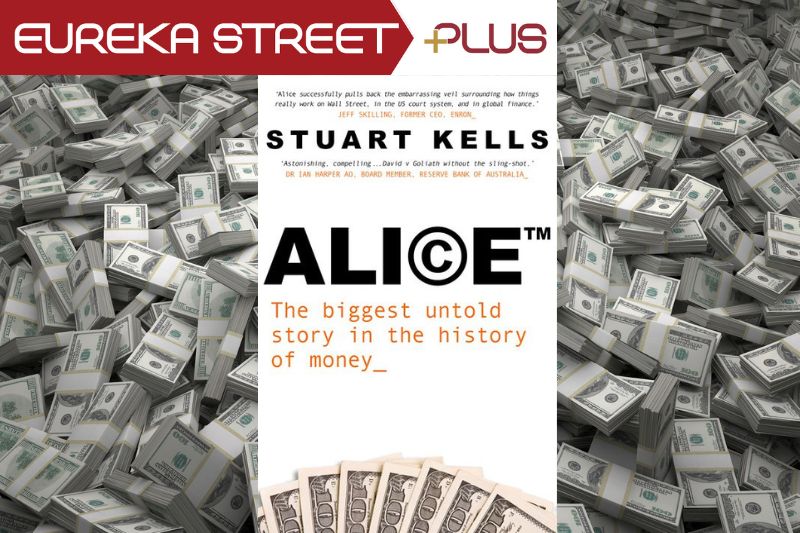

It is a truism to say that the way money is constructed defines the power structure under which we live. But allowing private actors to manipulate and game the financial system has not just given them extraordinary power, it has undermined the way money itself is understood.

READ MORE

-

INTERNATIONAL

- Kirsty Robertson

- 30 April 2024

One year after civil war erupted, Sudan has become one of the world’s worst humanitarian tragedies with around 5 million people experiencing emergency levels of hunger. This puts Sudan on the brink of famine. Sudanese leaders claim this is the crisis the world has forgotten.

READ MORE

-

AUSTRALIA

- Peter Mares

- 12 April 2024

1 Comment

The ABC’s recent Q+A housing special left many questions unasked and unanswered. Labor, Coalition and Green MPs all say they want more people to be able to buy their own homes. The most obvious way to achieve that would be to reduce the price of housing. Yet no politician will make that an explicit policy aim.

READ MORE

-

ECONOMICS

- David James

- 04 January 2024

From Moscow to Beijing, a change in global finance looms, set to challenge the long-standing economic hegemony. This imminent shift could redefine global power structures, disrupt currency markets and international trade. Amidst this uncertainty, one thing is clear: the game of geopolitical chess is no longer played on a Western-centric board.

READ MORE

-

ECONOMICS

- David James

- 23 November 2023

If money is just a set of rules, we need to ask, how can these rules best serve society and not cause crises? We know, after thousands of years of evidence, that the debt-based system of money eventually self-destructs, and this time, the effects are likely to be felt around the world.

READ MORE

-

ECONOMICS

- David James

- 10 October 2023

1 Comment

As Western economies grapple with soaring inflation rates, the once steady financial landscape is shifting, revealing looming challenges beneath mounting global debt. Amid 'Great Reset' calls, many face an uncertain future where the true cost of living is set to be redefined.

READ MORE

-

INTERNATIONAL

- Jim McDermott

- 03 August 2023

In a world captivated by streaming services, binge-watching hides a hidden crisis: writers and actors, cornered by the very industry they've enriched, face financial hardship and clashing with corporate greed, resonating with global struggles around labor and human value.

READ MORE

-

AUSTRALIA

- James Massola

- 14 July 2023

5 Comments

Catherine Holmes' Royal Commission report exposes the staggering mismanagement and human cost of Australia's Robodebt scandal. The scheme burdened over 500,000 Australians with non-existent debts and is linked to at least three suicides. This report unravels the culture behind the disaster and the potential repercussions ahead.

READ MORE

-

ECONOMICS

From Moscow to Beijing, a change in global finance looms, set to challenge the long-standing economic hegemony. This imminent shift could redefine global power structures, disrupt currency markets and international trade. Amidst this uncertainty, one thing is clear: the game of geopolitical chess is no longer played on a Western-centric board.

READ MORE