Keywords: Global Financial Crisis

There are more than 200 results, only the first 200 are displayed here.

-

ECONOMICS

- David James

- 10 December 2014

12 Comments

One of the fascinating aspects of Australia's political pantomime is the manner in which the Federal Treasurer is forced to metamorphose into a used car salesman who is spruiking the Australian economy. One reason for the relative impotence of the Treasurer is that the Federal government only has control over fiscal policy. Monetary policy, the interest rate, is set by the Reserve Bank, not the government.

READ MORE

-

ECONOMICS

- David James

- 19 November 2014

6 Comments

Investing capital in the production of goods and services may create jobs, but it's not the best way to make money. It's more profitable to manipulate the financial system to create more money from money, which is why the finance sector does so well. The polarisation of wealth is less extreme in Australia, but we have our own capital-driven Ponzi scheme - the residential property market, which has become an exercise in making money out of money.

READ MORE

-

AUSTRALIA

- Andrew Hamilton

- 14 November 2014

18 Comments

The news that Pope Francis has written a letter to Tony Abbott makes one pause. It is usual for Popes to write such letters, and luckily this one is no shirtfront. Instead it will probably be treated as a hospital pass. The trouble with swerving away from hospital passes, though, is that the watchers may see you as cowardly.

READ MORE

-

ECONOMICS

- David James

- 08 September 2014

7 Comments

What is only now starting to come into focus is the extent to which the whole economy is in hock to house prices. A sharp fall in the housing market will put intense pressure on our major lending institutions, leading to a deeply depressing effect on all parts of the economy. The regulators, as ever, are taking a hands-off approach.

READ MORE

-

MARGARET DOOLEY AWARD

- Andy Lynch

- 27 August 2014

9 Comments

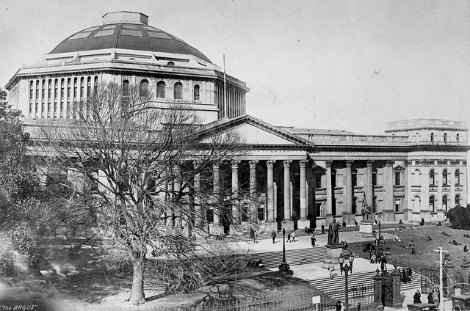

The kind of Australia we live in today can be directly attributed to the kinds of institutions built 150 years ago - schools, universities, libraries, museums, and more. But in 2014 is it even possible to carve out new public institutions or give new life to those that have waned in relevance?

READ MORE

-

ECONOMICS

- David James

- 13 August 2014

1 Comment

In 1976 management thinker Peter Drucker said the real owners of the stock market were workers, through their pension funds. A similar broadening of ownership has occurred in Australia since the creation of compulsory superannuation. But intermediaries called fund managers still stood between the people and ultimate control of their financial destiny, until the rise of the Self Managed Super Fund (SMSF).

READ MORE

-

AUSTRALIA

- Andra Jackson

- 04 August 2014

25 Comments

While the Federal Government continues to cast around for other Pacific nations and Cambodia to take in refugees held on Manus Island and Nauru, it has one ready solution right on its own doorstep. It is a place that has been calling out for help to counter its falling population and its prolonged economic crisis. It is an Australian territory and one that is already receiving Australia's financial support.

READ MORE

-

ECONOMICS

As the Pope and economist Thomas Pikkety have observed in recent times, the inequity created by capitalism is a growing concern. But the problem with this argument is that 'capitalism' is too broad a term. The attack would be far better directed against the financialisation of developed economies. A new type of sovereign has emerged, and like all rulers they are cheerfully engaging in acts of plunder.

READ MORE

-

ECONOMICS

- Brian Toohey

- 11 June 2014

15 Comments

The superannuation industry inhabits a cosseted world in which the money pours in thanks to a combination of government compulsion and tax concessions. The foundations of this empire are criticised for how the tax concessions create an expensive form of upper class welfare, and for the harmful effect of compulsory super's artificial expansion of the finance sector. The Abbott Government shows scant concern about either aspect.

READ MORE

-

ECONOMICS

In politics, one should never opt for a balanced and thoughtful description of the truth when wild exaggerations will do. Especially when you want to take from the poor and give to, if not exactly the rich, at least the investor class. The dire pronouncements from the Abbott Government in response to the Commission of Audit's 86 recommendations reflect not only the PM's relentless negativity, but also more than a whiff of class war.

READ MORE

-

ECONOMICS

- David James

- 26 March 2014

6 Comments

Removing the requirement that financial advisers act in the best interest of their clients will reveal financial advisers for what they really are: salespeople for the banks' wealth management platforms. Tony Abbott argues that the changes will remove 'red tape' and declaimed: 'We're creating the biggest bonfire of regulations in our country's history.' This is a duplicitous use of language that misunderstands how the finance sector works.

READ MORE

-

ECONOMICS

- Bruce Duncan

- 04 February 2014

14 Comments

The budget problems are not caused by Newstart or disability pensions, which have been declining as a proportion of economic activity. Had the Howard Government not been so generous with its tax cuts to upper and middle income groups, there would today be no budget deficit.

READ MORE